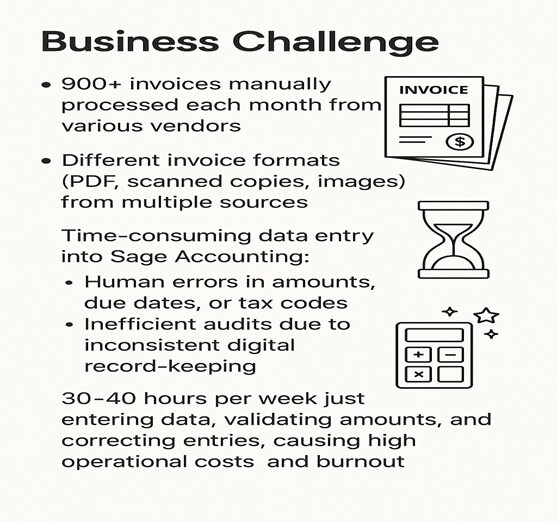

1. Business Challenges

Manual invoice processing had become a significant operational bottleneck for a mid-sized service-based company, especially within the Accounts Payable (AP) department. The team was handling over 900 invoices each month, received from a diverse range of vendors in various formats—including PDFs, scanned documents, and even mobile-captured images. Due to the lack of standardization, each invoice required manual inspection and data entry into Sage Accounting, a process that was both time-consuming and error-prone.

Common issues included incorrect amounts, misapplied tax codes, and inaccurate due dates, all of which resulted in payment delays that negatively impacted vendor relationships. Additionally, the inconsistent digital record-keeping made internal audits inefficient and stressful. On average, the AP team was dedicating 30 to 40 hours per week just to manage invoices, validate line items, and correct entry mistakes—leading to increased operational costs, limited scalability, and significant employee fatigue.

Error Rate: Manual invoice processing typically results in an average error rate of 1.6% per invoice, which can stem from incorrect amounts, mismatched PO numbers, or wrong vendor details. Fixing a single error may cost up to $53, including staff time and system corrections.

Cost per Invoice: According to the Institute of Finance & Management (IOFM) and Ardent Partners, processing a single invoice manually can cost between $15 and $40, depending on complexity and organizational factors.

Processing Time: A full manual workflow—from receipt to entry, approval, and filing—takes about 15 minutes per invoice, equating to approximately 5 invoices per hour.

Indirect Rework Needs: Around 12.5% of invoices processed manually require rework due to errors, necessitating additional verification and correction steps, which further increase time and labor burdens.

Cumulative Time Loss: If each invoice takes just 5 minutes more than an automated process, organizations handling tens of thousands of invoices annually can lose 3,300+ hours per year—essentially the workload of a full-time employee.

2. Solution

To eliminate the inefficiencies of manual invoice processing, the organization engineered a custom OCR-powered automation pipeline designed for performance, adaptability, and integration with Sage Accounting. At the heart of this solution is a high-performance OCR engine that combines the strengths of Tesseract and EasyOCR, both fine-tuned to run on GPU. This ensures rapid extraction of data even from low-quality scans, skewed layouts, or handwritten content. To enhance accuracy, the pipeline uses a layered image preprocessing routine that includes grayscale conversion, noise filtering, edge detection, and adaptive thresholding—ensuring optimal conditions for text recognition.

What truly differentiated the solution was the development of a user-defined entity extraction framework. Instead of relying solely on raw OCR output, this layer enables the system to flexibly extract relevant information based on customized rules, regex patterns, and contextual tagging. For example, it could reliably detect invoice fields like Invoice Number, Vendor Name, Invoice Date, Total Amount, Due Date, and Tax Codes,regardless of the vendor’s document format. Where traditional OCR tools fail due to layout variability, this system used a proprietary algorithmic logic to infer field relationships, identify missing data, and handle irregular formatting across vendors.

The pipeline also featured a data validation layer equipped with business logic checks to eliminate common errors. It could flag issues like tax miscalculations, duplicate invoice numbers, or unmatched PO references. Clean, structured data was then seamlessly pushed into Sage Accounting through API integration, creating entries in real time without the need for human involvement.

Moreover, the platform included a lightweight UI and audit trail, allowing the AP team to manually review and approve exceptions. This ensured that while 90–95% of the invoices were processed automatically, edge cases could still be handled with oversight. The architecture was built with scalability in mind, capable of handling 1,000+ invoices per batch and extendable to multi-company and multi-vendor environments.

This approach not only modernized the invoice workflow but also empowered the AP team by freeing up time for strategic finance tasks, drastically reducing errors, and enabling faster payment cycles—all while maintaining full compliance and audit readiness.

2a. Key Solution Insights

- Custom OCR Engine built using Tesseract + EasyOCR, GPU-accelerated for fast and scalable processing.

- Smart Preprocessing Pipeline: Deskewing, noise removal, thresholding for optimal text clarity.

- User-Defined Entity Extraction: Regex + context-aware rules. Extracts Invoice Number, Vendor Name, Date, Amount, Tax.

- Proprietary Algorithmic Logic: Handles multi-format invoices. Recognizes misaligned, rotated, or low-quality documents

3. Results

The implementation of the OCR-based invoice automation system delivered immediate, measurable improvements across operational efficiency, cost savings, and data accuracy. Within just the first two months of deployment, the organization observed a transformational shift in its Accounts Payable workflow.

- Time Savings: Manual processing time per invoice dropped from 15+ minutes to under 2 minutes, thanks to GPU-accelerated extraction and automated entity mapping. The AP team’s invoice workload reduced by 85–90%, freeing up over 120+ hours per month.

- Error Reduction: Data entry errors—previously affecting 8–12% of invoices—fell to below 1.5%, due to rule-based validations and automated formatting. Duplicate entries and mismatches were flagged instantly before reaching Sage Accounting.

- Cost Efficiency: Estimated cost per invoice was reduced from $18.50 (manual) to $2.75 (automated)—resulting in annual savings of over $160,000 based on 900+ invoices per month.

- Faster Processing & Approvals: Invoice approval times dropped from 3–5 days to under 1 business day, enabling timely vendor payments and improved cash flow management.

- Audit & Compliance Readiness: Structured digital logs, consistent invoice formatting, and data traceability significantly reduced audit prep time from 2 weeks to under 3 days.

- Scalability & Reliability: The system handled an increase in volume (up to 1,100 invoices) without additional strain, demonstrating robustness and future-readiness.